If you own property in the Austin area, chances are you recently received your latest property appraisal. This number, known as your appraised value, is an estimate from the Travis Central Appraisal District of what your home would sell for in Austin’s current housing market.

Last year, appraisals went up a whopping 50 percent on average – a reflection of the city’s record-setting housing market. But the market since mid-2022 has looked very different, in part because of rising mortgage interest rates, which make it more expensive to buy a home.

This year’s appraisals mirror the new market reality. On average, home appraisals went up by just 0.08 percent according to the appraisal district. Many people will likely see their appraisals have dropped.

So, what does this all mean for property taxes?

Appraisals may have changed, but how confusing this all is has not. Let’s dig in.

My home was appraised for less than last year. Does that mean my taxes will go down?

Hard to say.

If you’ve owned your home for at least several years, it’s likely that your appraised value is not the amount you’re taxed on. (This is where people’s eyes start to glaze over, but bear with me.)

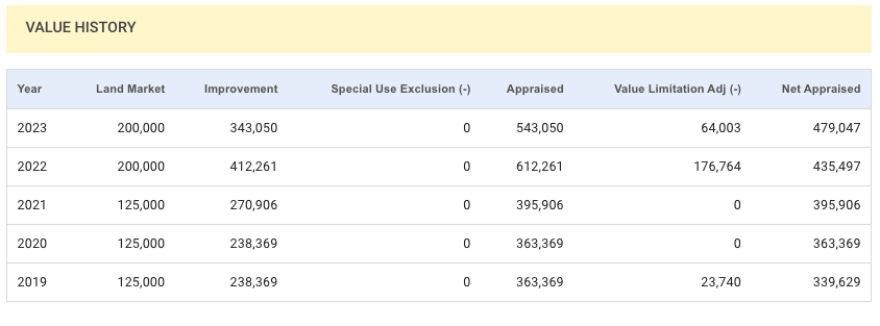

Let’s take a look at the home appraisal data for KUT’s managing editor, Ben Philpott. Philpott bought his home in 2003 for about $178,000. This year, it’s been appraised at $543,050 – meaning the value of his home has tripled in two decades.

Note that Philpott’s appraised value went down from last year by about 12 percent.

Now, this “appraised” number is not what Philpott will pay taxes on. He’ll instead pay taxes on that “net appraised” number, which is much lower at $479,047.

Even though his appraisal went down, the amount Philpott will pay taxes on went up. Why?

When you buy your home, the appraised and net appraised numbers are the same. But while one is subject to the whims of the market (“appraised”) and goes up or down, the other (“net appraised”) can only increase 10 percent each year, per state law.

So, as prices in Austin’s housing market have consistently risen over the past decade, many homeowners’ “appraised” value has gotten much higher than the “net appraised.”

You pay taxes on whichever figure is lower.

I’ll ask again: What will happen to my taxes?

Patience, dear friend.

We have to wait until this fall when taxing entities – including the city, county and local school districts – set their tax rates. This will determine how much in tax money you owe. For example, last year the city of Austin proposed taxing people at a rate of 45 cents per $100 of their home value. So, if your home is valued at $500,000, for example, you’d owe $2,250 to the city in property taxes.

But most likely, your taxable amount will be even smaller. That’s because taxing entities offer discounts if you live in the home you own (and have filed what’s called a homestead exemption) or if you’re 65 or older.

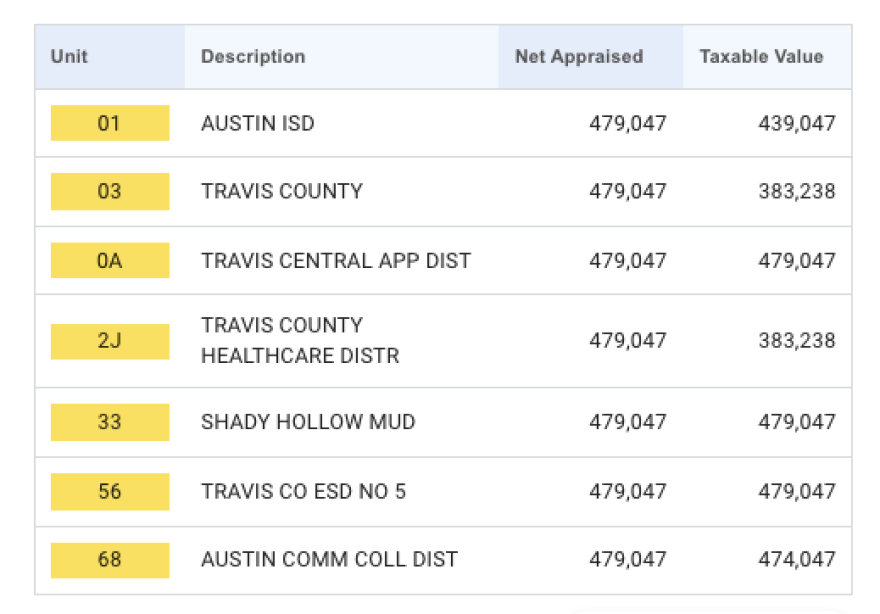

You can see how much Philpott will be taxed on per taxing entity:

What if I don’t agree with my property appraisal?

If you think your appraised value is way off, you have until mid-May to contest it. You cannot contest your net appraised value, though, which is likely the amount you’ll be taxed on.

If you consistently protest your appraisal and succeed in getting it lowered, you may be able to get it closer to that net appraised value. This could help in a market like today’s, which very few people could have anticipated, where home values are falling. If your appraised value gets lower than your net appraised, it becomes your new taxable value.

This story was produced as part of the Austin Monitor’s reporting partnership with KUT.

The Austin Monitor’s work is made possible by donations from the community. Though our reporting covers donors from time to time, we are careful to keep business and editorial efforts separate while maintaining transparency. A complete list of donors is available here, and our code of ethics is explained here.