Council OKs Smoot Terrace Park Historic District

Friday, August 31, 2018 by

Jo Clifton Council gave final approval Thursday to creation of the Smoot Terrace Park Historic District just west of downtown, after neighbors decided to eliminate three properties owned by people who signed a valid petition opposing the historic district.

That meant Council could designate the district without a supermajority of nine votes – which is required by the valid petition. With only eight Council members voting in favor of the district, the decision to exclude those properties turned out to be an important one. Council members Jimmy Flannigan, Delia Garza and Ellen Troxclair voted no.

Deputy Historic Preservation Officer Cara Bertron told Council the area, which is part of the West Line National Register Historic District, developed over more than a century “in waves of development that paralleled the growth of middle-class housing in Austin as a whole.”

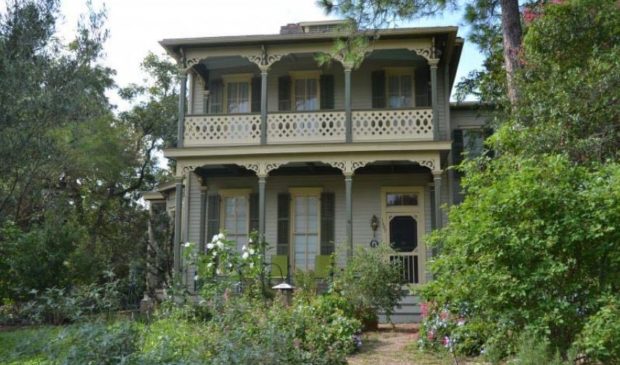

The development began in the 1870s. One of the original property owners was James H. Raymond, who served as treasurer of both the Republic of Texas and the state of Texas. According to documentation from Preservation Austin, the historic anchors of the area include the Smoot House on West Sixth Street, the Johnson House on West 6 1/2 Street, and the William Pillow House and the Ben Pillow House, both on West Ninth Street.

Bertron said staff was not in favor of removing the three properties from the district, even though they were nonconforming. She told the Austin Monitor, “We make professional recommendations, and it seemed important to be clear that we believe including a stretch of properties is preferable for historic context.” However, she said that in spite of that, staff still believe the district will be a very strong one and support it.

Proponents of the district, including the applicant, Denise Younger, stressed that there is strong support for the district among the owner-occupied homes, but opposition from investor-owned properties.

Younger said 65 percent of the property in the district is zoned Multi-Family Residence – Moderate-High Density (MF-4), giving property owners the opportunity to build ADUs. “We have plenty of apartment complexes and density – something that has happened and can continue to happen under the proposed district,” she said.

There was a complicated argument about whether such a district would preserve affordable housing or add to the cost of housing. Council Member Greg Casar noted that he had learned that under the local historic district designation, homeowners would follow pre-World War II design standards. What that means, he said, is “we are essentially going back to the older code” in ways that allow for more density.

Although most of those in the audience expressed support for the district, a couple of people came to ask Council not to vote for it.

Linda Cangelosi, who lives in the district, recalled neighborhood residents opposing building new homes on vacant property. While other neighbors described attending the Historic Landmark Commission monthly meetings in order to oppose demolitions in the neighborhood, Cangelosi said demolitions were not a problem. “Other neighborhoods need protection. This one does not,” she said.

Greg Jacobson said, “This issue of affordable housing is being turned a bit on its head,” when the comparison is made between the cost of new single-family housing and old single-family housing. The real comparison, he said, should be with rental housing.

“The reason why the non-owner-occupants are opposed” to the historic district designation, Jacobson said, “is because they are the ones tasked with providing affordable housing – rental housing. This is a ‘haves’ trying to protect their territory against the ‘have-nots’ from coming in.”

Unlike individual historic designation, inclusion in a historic district does not gives the property owner an automatic reduction in taxes. However, Bertron said property owners could get a tax abatement if they fix their nonconforming houses to be conforming or rehabilitate their conforming houses. In that case, she said their property taxes would be frozen for about seven years.

Photo courtesy of the city of Austin.

The Austin Monitor’s work is made possible by donations from the community. Though our reporting covers donors from time to time, we are careful to keep business and editorial efforts separate while maintaining transparency. A complete list of donors is available here, and our code of ethics is explained here.

You're a community leader

And we’re honored you look to us for serious, in-depth news. You know a strong community needs local and dedicated watchdog reporting. We’re here for you and that won’t change. Now will you take the powerful next step and support our nonprofit news organization?