Local pols examine impacts, options in state school funding debate

Thursday, December 6, 2018 by

Chad Swiatecki Leaders from all levels of government in Central Texas, plus most of the area’s school districts, learned Wednesday that they could be in for budgetary hits if state lawmakers pass limits on local property tax increases without restructuring the state’s funding system for public education.

The symposium at the Austin Convention Center saw most of Austin City Council and Travis County’s Commissioners Court, plus current and recently elected state representatives and members of assorted local associations, gather for a series of presentations about the consequences of the state’s so-called “recapture” system, which redistributes school property tax funds from high-income areas to shore up state funding for education and other areas.

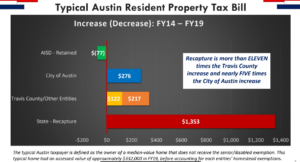

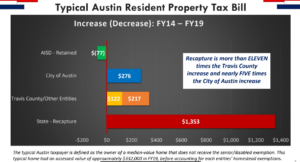

With bill filing for next year’s session of the Legislature already underway, it has become apparent to many that slowing the growth of property taxes is a priority in both of the Republican-controlled chambers of the Legislature. Among the concerns is a plan proposed by Gov. Greg Abbott that would limit annual property tax increases to 2.5 percent annually, instead of the roughly 7 percent that has been typical in the Austin area in recent years. The principal driver of those increases has been property taxes collected through the Austin Independent School District, though as of this year more than half of the property tax money collected by the district is sent to the state.

Ed Van Eenoo, Austin’s deputy chief financial officer, said estimates of the past five years of Austin’s budgets found that such a limit would have taken $93 million out of the city’s budget, or enough to pay the salaries of more than 1,100 full-time firefighters.

“The idea that it’s the local entities that are driving the tax bill increases in the city is just not correct. It’s really being driven by the recapture system and the rapid growth of revenue redirected to the state,” Van Eenoo said, adding that similar disparities show up in Del Valle, Eames, Elgin and other surrounding districts. “The growth of tax bills in the area in the last five years is being driven by schools and by the broken school finance system. It’s driven by the state’s over-reliance on property taxes to fund other needs.”

For the school districts, the recapture system represents a growing siphon on the amount of funding available for basic needs.

Nicole Conley Johnson, chief of business and operations for AISD, said area districts experiencing growth that are about to become recapture payers will see an immediate cut of 10 to 15 percent of their budgets with payments to the state growing annually.

“There’s many concerns we need to be mindful of as the legislators go in and contemplate the governor’s proposals, and we’re sort of carefully watching and hoping that many of these answers can be smoothed out in the end,” she said. “We want to see the legislators take into account these concerns, and my biggest fear is education will just get what’s left over from property tax relief. We all know how important it is to give some relief to our taxpayers, but at the same time our local taxpayers have also said they want to see investments made into public education in a meaningful way.”

Wednesday’s session was in many ways a chance for local politicians and other leaders to begin planning how to marshal their lobbying and public engagement efforts on two fronts: lessening the caps on property taxes and making the state more directly responsible for covering the cost of public education.

Locally, Austin City Council Member Alison Alter provided information about the new education funding activism group Just Fund It Texas.

State Rep. Donna Howard said she hopes to have a seat on the state’s appropriations committee concerning education so she can push her fellow lawmakers for meaningful funding reform.

“The limited government, limited taxes ideology has been conflated with this (education) issue and that’s really not what this is supposed to be about,” she told the Austin Monitor. “There are those, though, who that’s still their primary purpose ideologically and that’s where the big divide is.

“There is strong bipartisan support for bringing property taxes down, but realizing that we need to replace them with some other sustainable source of revenue and that we need to put more into public education,” Howard continued. “Because of the last election there will be a moderating effect on what comes out policy-wise and more of a willingness to not go into the knee-jerk no-new-taxes rhetoric, so there will be some cover for some of my Republican colleagues.”

Photo by Stuart Seeger made available through a Creative Commons license. Graph courtesy of the city of Austin.

The Austin Monitor’s work is made possible by donations from the community. Though our reporting covers donors from time to time, we are careful to keep business and editorial efforts separate while maintaining transparency. A complete list of donors is available here, and our code of ethics is explained here.

You're a community leader

And we’re honored you look to us for serious, in-depth news. You know a strong community needs local and dedicated watchdog reporting. We’re here for you and that won’t change. Now will you take the powerful next step and support our nonprofit news organization?